Less than half the people in the world set a budget and adhere to it. This basic financial mistake often leads to overspending and eventual economic troubles. These five simple methods will help anyone set a budget that they can live comfortably with.

These apps are useful for beginners and those who don’t already set budgets. If you already have a budget and are looking to level-up or learn new methods and tools to save, you should check out Mint or YNAB, two of the best budgeting apps. Not only do they make it easier, but they also teach you saving skills.

Fifty Thirty Twenty (Web): Elizabeth Warren’s Budgeting Method

US Senator Elizabeth Warren, who is also running for President, popularized the 50-30-20 rule of budgeting in a book in 2005. Warren advises splitting your income such that you spend 50% on things you need (like rent, utilities, groceries, etc.), 30% on things you want (internet, entertainment, dining out, etc.), and 20% on savings and paying debt (student loans, retirement funds, etc.).

The system has become very popular, but how realistic is it? Fifty Thirty Twenty takes the rule and applies it to the average US citizen today. Using government-provided figures, this interactive guide shows who can and cannot live with the 50-30-20 rule, and suggests other methods too.

That said, the 50-30-20 budget is about living within your means. Even if it seems difficult, perhaps making some hard choices could make it work for you in the long term. To calculate the 50-30-20 budget for yourself, use the website’s 50-30-20 Budgeting Worksheet or NerdWallet’s calculator. Fill it out and you’ll find where you need to cut expenses to live within the 50-30-20 rules.

Moplan (Android): How Much Can You Spend Today?

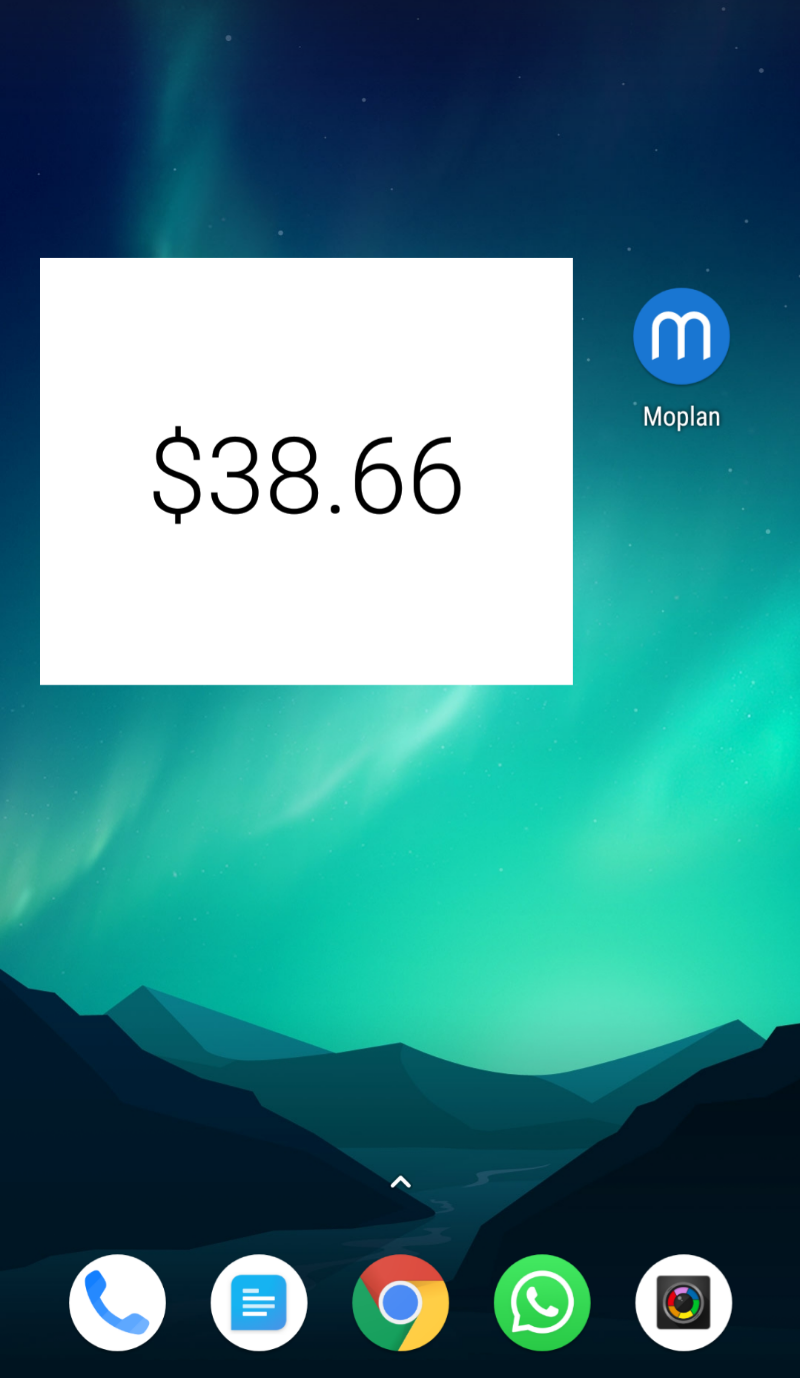

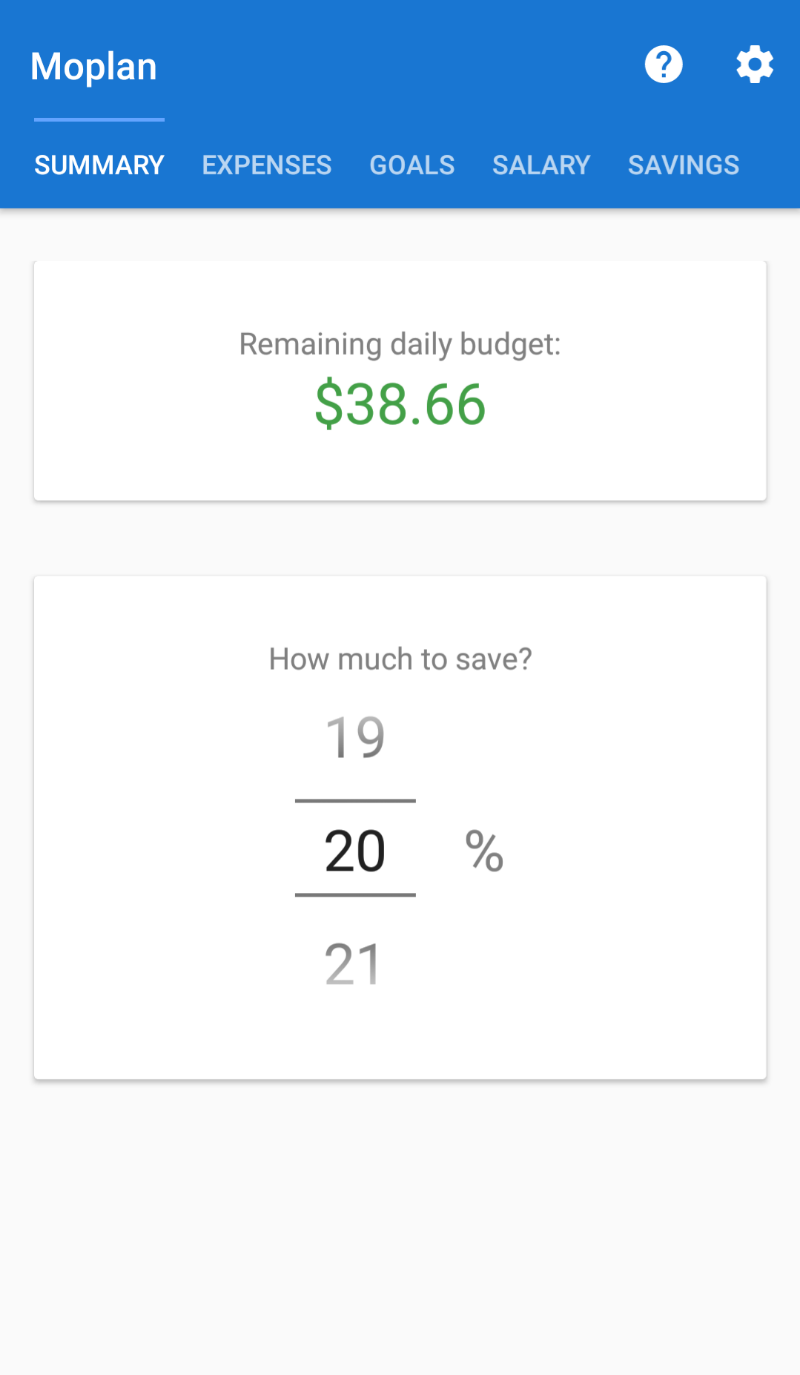

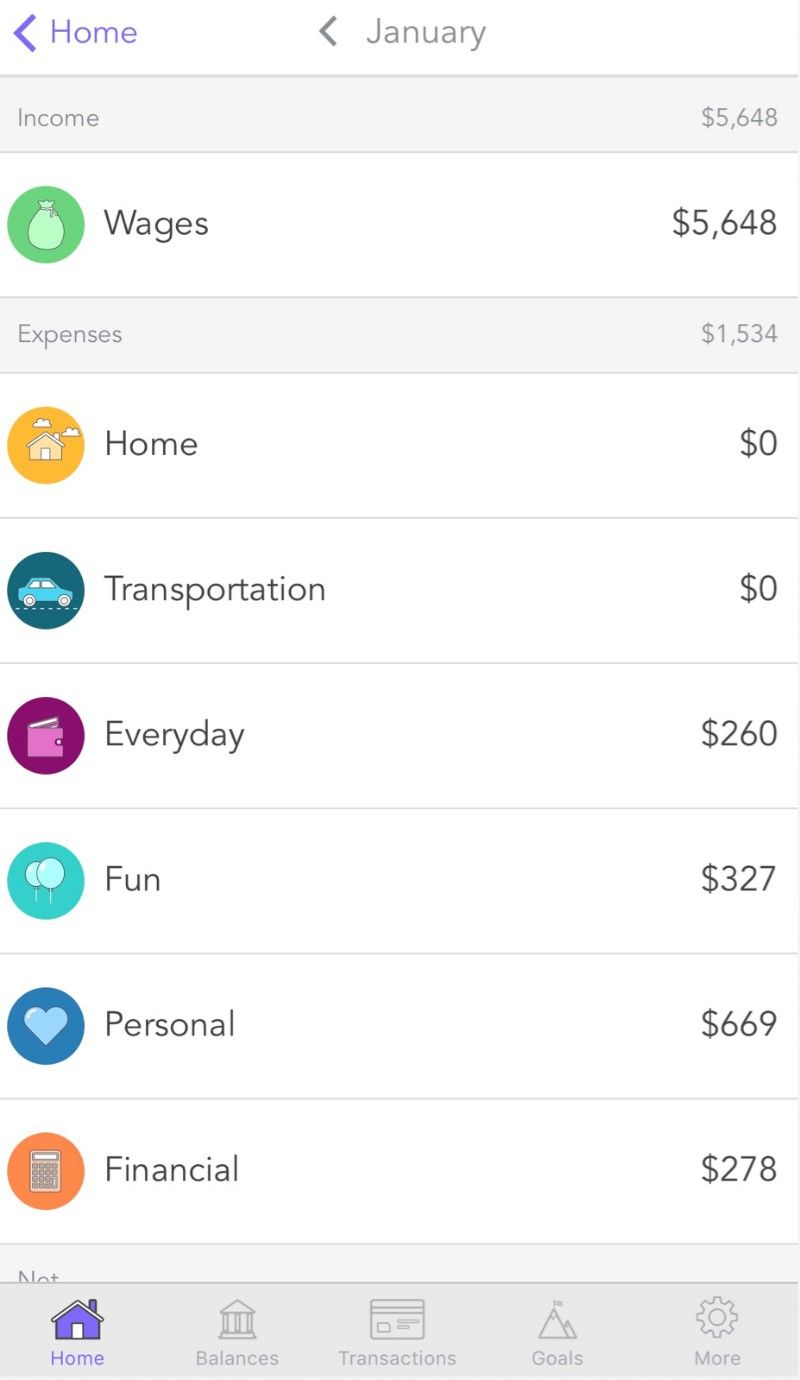

Moplan is the simplest app for budgeting beginners who need a constant reminder of their limits. Especially if you newly have a daily limit on expenditures, it can be difficult to track and stick to it. Set up Moplan and then add its handy widget to your homescreen, so you are constantly aware of how much you can spend today.

The app is ideal for those who have regular paydays and bill days. When you start the app the first time, you need to add your income and regular expenses, as well as their due dates. This lets Moplan create a daily expenditure limit for you.

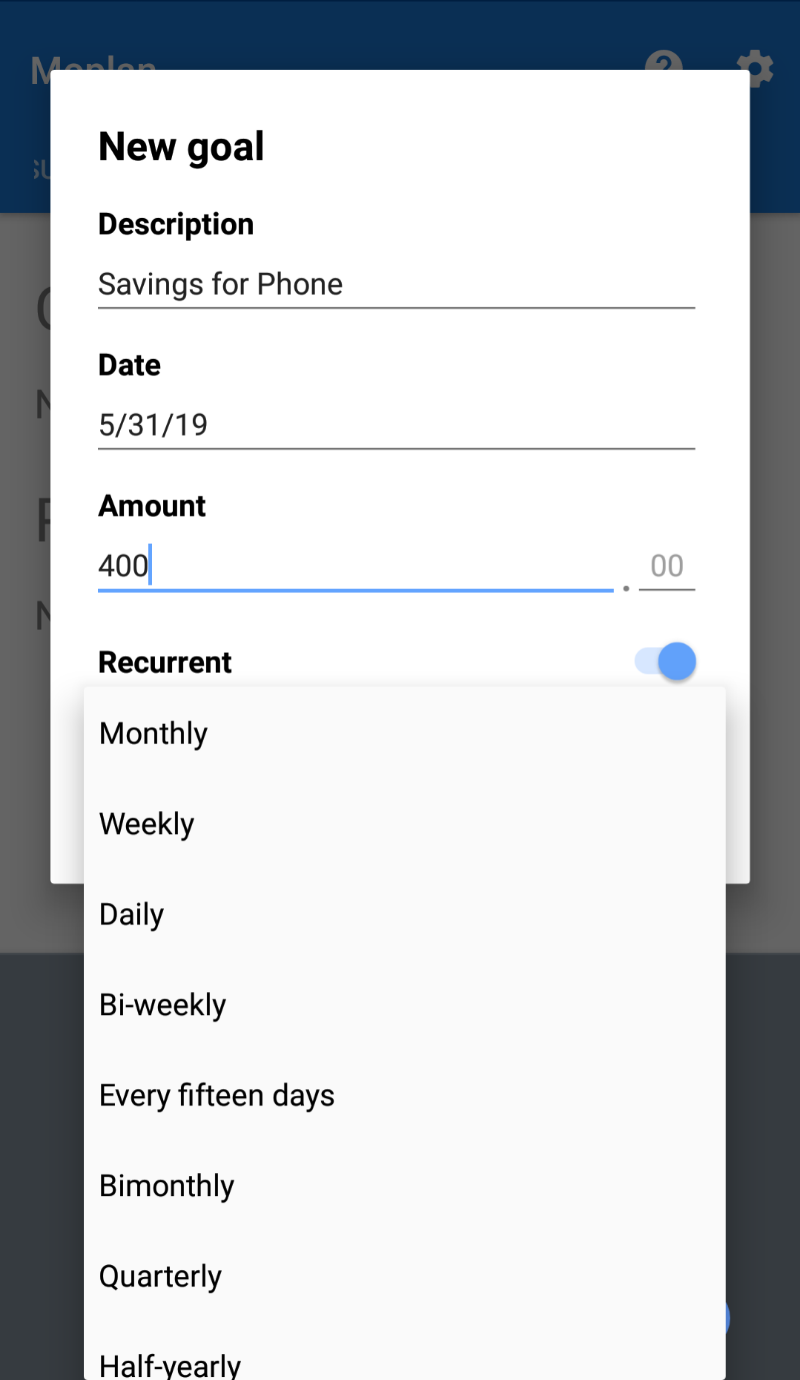

You can also set a savings target in percentage, as well as “Goals” for things you want. You’ll need to do the goal’s split yourself if you want to save money over some time.

Every time you spend money during the day, add it into Moplan. This updates the daily expenditure limit widget, reminding you how much you can spend. It can seem daunting at first, but this is one of those good financial habits that will serve you well in the long term.

Download: Moplan for Android (Free)

Beginner’s Spreadsheet (Google Docs): Redditor’s Free Template

This is one of the most impressive budgeting spreadsheets I have seen, especially for how simple it is to use. Reddit user Celesmeh shared this personal spreadsheet for people who don’t know how to budget. The idea is to make a daily budget for yourself, which supports long-term goals as well.

The spreadsheet, which you can copy in Google Docs and download to use offline, shows a snapshot of your daily spending limit, monthly earnings and expenditures, flex spending, and a pie chart of where your money is going. How it reaches this snapshot is the interesting part.

Each aspect of your money is broken down in the simplest format possible. Add income and expenses, credit card payments, large goals, tips, daily expenses, and almost anything else related to your money. The calculator will take care of everything. You can even rename elements or add new ones.

The spreadsheet includes detailed instructions on how to use it so you can get started immediately. If you like what you see, read Celesmeh’s original post for discussions and ideas.

Download: Budget-again for Google Docs (Free)

Paper and Excel Tracker: A Guide on Annual Personal Budgeting

Apps aren’t for everyone. Some prefer a simple paper-and-pen approach to keep track of expenditures and receipts. Reddit user WhiskeySauer put together a guide on how to do that, convert it into data on an Excel spreadsheet, and use it to budget your living.

WhiskeySauer recommends using a folder to track and store all your expenses and receipts, along with a blank page that lists every foreseeable expense already. You fill the sheet manually with a pen, which can help in crystallizing your expenditures much like writing notes can help in remembering them later.

At the end of the month, add all that data into the spreadsheet to get a snapshot of your annual budget, spending patterns, and other useful information.

Note: WhiskeySauer’s spreadsheet link isn’t working right now, but it would be easy to make your own Excel based on the screenshot guide, or you can wait for an updated link.

Honeyfi (Android, iOS): Budgeting for Couples

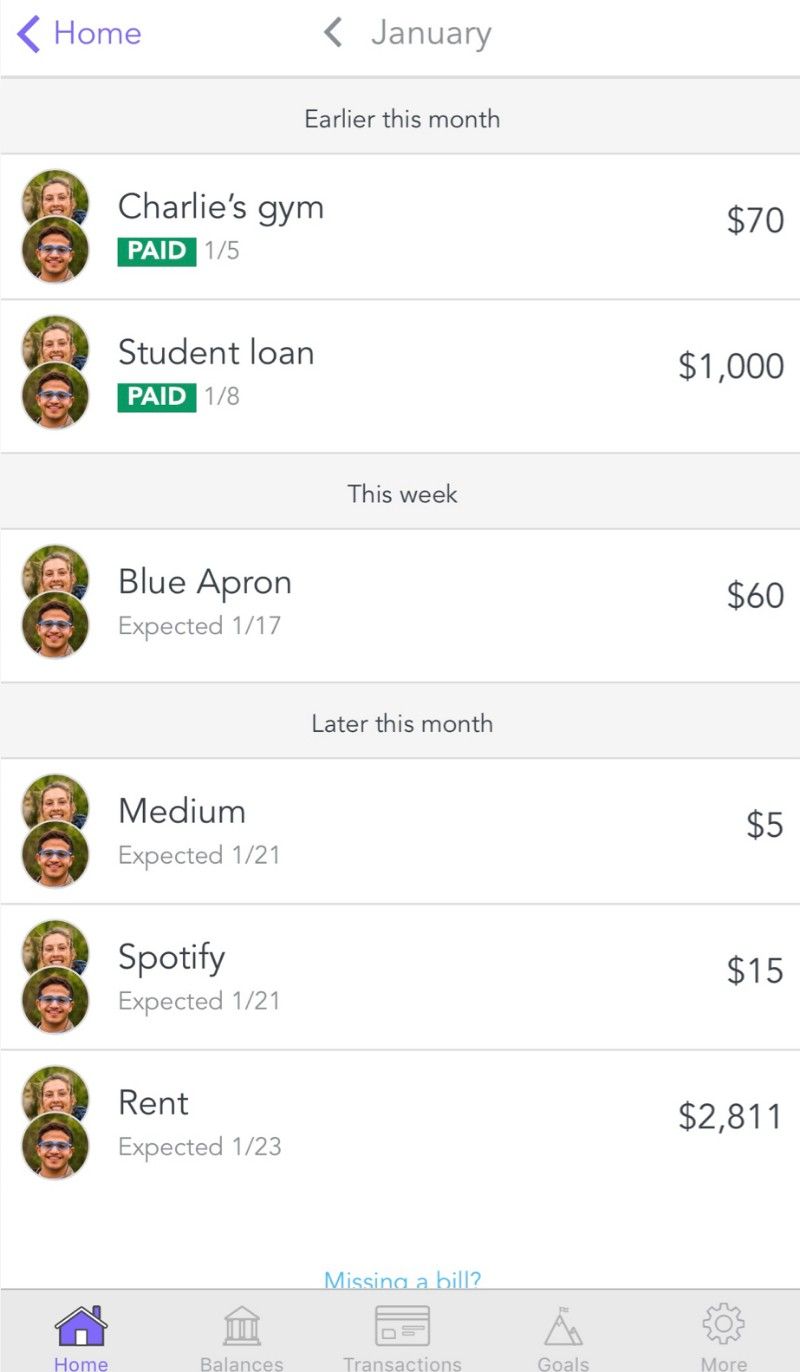

If you and your significant other have intertwined finances, you need an app that can set a budget together. Honeyfi works on both Android and iOS, and has all the features that a couple would need to set joint financial goals.

US citizens can link their Venmo accounts, credit cards, and manually add transactions too. You can add comments to a transaction to explain it to your partner, or as a note for yourself to remember later.

Like any other budgeting app, you can add incomes, expenses, upcoming bills, and all that jazz. But turning it into a shared dashboard of your coupled finances is where it helps the most.

Download: Honeyfi for Android | iOS (Free)

Try Out Simple Calculators

Much like the 50-30-20 budgeting rule, there are other budgeting methods and formulas that different financial advisors recommend. Most of these can be translated into simple calculators, which are available for free online.

Financial guru Dave Ramsey’s seven-step budgeting system, for example, is available as a free app called EveryDollar. Try it out, as well as other great budget calculators, to figure out the best financial management approach for yourself.

Read the full article: 5 Simple Ways to Set a Budget and Avoid Overspending