Teaching children to be financially responsible adults isn’t always easy when sites like PayPal ban children under 18 years old from using their service. Thankfully there are many financial alternatives to PayPal that you can use to teach your kids about saving and managing money.

Despite PayPal’s ban, there are creative ways to provide your children with places to save their money. These are accounts that give you “custodial” control, so you can monitor how your kids are doing and step in if you see them getting into trouble.

Why Does PayPal Have an Age Limit?

PayPal used to offer a PayPal Student account, but that service was eventually discontinued.

According to PayPal’s website, they don’t allow anyone under 18 to open an account because no one under 18 is allowed to enter into a legal contract in the United States:

“When you open a PayPal account, you are agreeing to a binding legal contract. Before an individual can enter into a binding legal agreement known as a contract, he or she must meet the legal contract age. The legal contract age is also referred to as the age of majority, which is 18 years old in most jurisdictions.”

Even though there are other banks and financial institutions that get around this restriction by offering teen accounts linked to parental custodial accounts, PayPal has decided to offer nothing of the sort. This introduces a new need for PayPal alternatives for teenagers.

Online Banking Accounts for Teens

No matter where you turn to create any online financial account like PayPal, inevitably you’re going to need a bank account to transfer money to and from.

One of the simplest solutions is just to create an actual bank account that teens are allowed to use, complete with an actual debit card, checks, and every other benefit that comes from having a bank account.

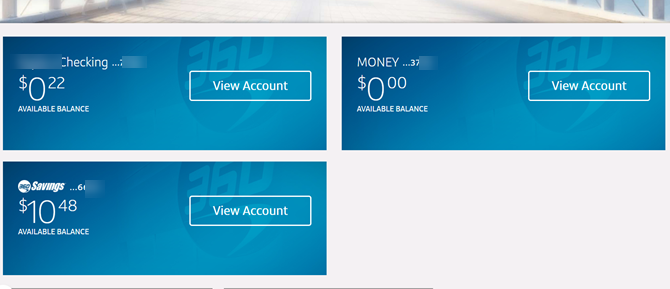

CapitalOne 360 Money

CapitalOne solved the need for teen bank accounts by providing what’s called a CapitalOne 360 “Money” account. A Money account is a zero-fee teen checking account.

Some of the benefits of a CapitalOne 360 Money account includes:

- No fees or balance requirements

- A free debit card teens can use at any store that accepts MasterCard

- Text alerts to both teens and parents for low balances

- Fee-free ATMs across the country

- Accounts earn interest

An actual bank account puts your teen on the path of understanding how banking works, how interest accumulates as you save money, and how to manage money from month to month.

The fact that the account requires a parent to “support” it means you have the ability to step in and assist if your teen needs it. You can transfer money in and out of the account from your own external bank account.

Other Online Banking Alternatives

CapitalOne isn’t the only company to get into the teen banking game. A few other banks have stepped up to help out with student banking accounts.

- Bank of America Student Banking: No monthly maintenance fee, online/mobile banking, and the ability to send and receive money via the Zelle online payment service.

- Alliant: Available for kids aged 13-17 years old, start a joint account for your child with no minimum balance, no monthly fees, online/mobile banking, and interest rates more than twice that of other teen bank accounts.

- Chase: A “high school checking” account is available for students 13-17 years old, without a monthly fee if linked to a parent’s bank account. Chase tends to have a lot of fees like ATM and overdraft fees, but this is a good opportunity to teach your teen how to avoid such “big bank” fees.

- Huntington Bank: Anyone under 18 can open a Huntington Bank student account so long as someone over 18 is willing to open it as a co-signer or as a joining account. Huntington Bank doesn’t provide account details online so make sure to read the fine print when you sign up.

- Wells Fargo: A teen account is available to any student aged 13-17, with a parent account linked the account. Parents can place limits on purchases, and students can bank from their mobile phone or online. You can avoid the monthly fee if you opt for online statements.

Not only national banks offer student accounts. It’s likely that your local bank or credit union may have some options for students as well. So, check with your own local bank and ask if they offer free or no-fee checking accounts for students that parents can co-sign for.

Prepaid Debit Cards for Teenagers

If you just want a simple place where you can store money for your kids to use, you don’t actually have to go through the hassle of opening up a bank account.

You can stop at any pharmacy or supemarket and purchase a refillable prepaid card for your child to use.

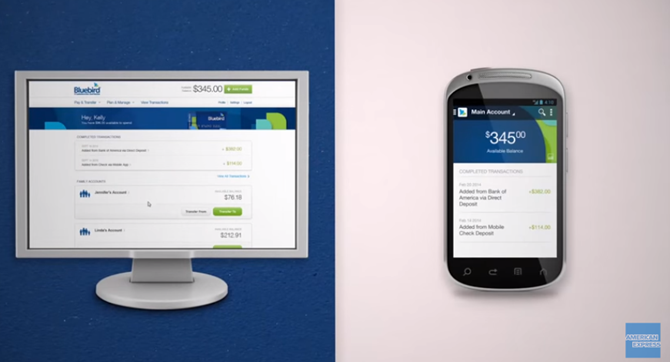

American Express: Bluebird

Bluebird by American Express is like a hybrid between a bank account and a credit card.

The cool thing about it is with one “family account” you can provide a different card to up to four other family members. From your central account, you can quickly transfer money to those cards, set limits on spending, and monitor activity.

It’s probably one of the best solutions for parents who want to dole out allowances to children and get them started learning how to use credit cards responsibly.

Download: Bluebird for Android | iOS (Free)

MyVanilla Visa Card

An even simpler solution is to purchase a Vanilla Visa gift card, available at most supermarkets or at Walmart.

Minors can’t purchase these cards. However, parents are allowed to purchase the card, sign the agreement, and then add the minor as a registered user of the card.

Some features of the MyVanilla Visa Card include:

- A mobile app to check and manage the account

- Easily load more money onto the card at a long list of participating retailers

- No credit check required

- Zero liability policy if the card gets lost, makes it much safe than carrying cash

All of these make MyVanilla an ideal first “credit card” for minors, without the hassle of opening a checking account.

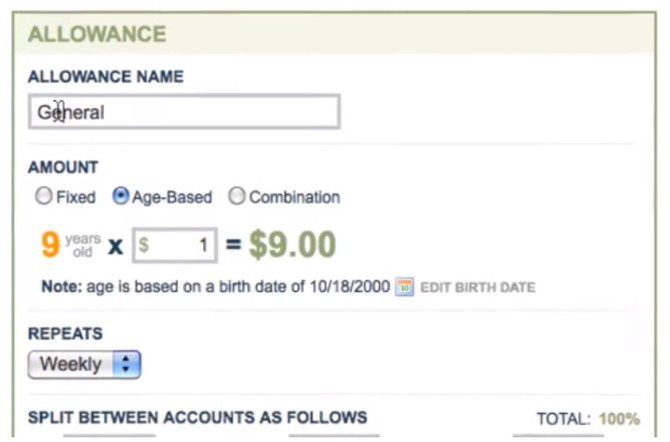

FamZoo Family Accounts

One of the coolest ways to manage a number of child accounts in a single family management platform is FamZoo.

Famzoo is like Bluebird on steroids. It offers everything the American Express Bluebird account offers, including a prepaid card for each child. However what it lacks are most of the fees you’ll find when you sign up for student accounts with any of the big banks.

The best feature here is the automation. You can set up allowance amounts for each child, and have that automatically transfer into their cards at whatever interval you set up.

You can even connect scheduled chores and jobs to payments or penalties. This is a great way to teach kids about the connection between work and income.

If you’re a really strict parent, you can seven set up “billing”, where you charge your kids for things like their share of the mobile phone bill!

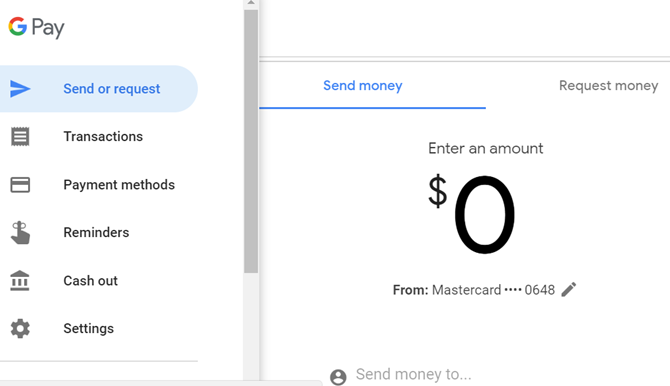

Google Pay

Google Pay (formerly Google Wallet but now combined with Android Pay) is an interesting alternative to PayPal.

It’s available for any teenager over 13, so long as a parent provides permission and accepts the terms. After that, parents can connect a bank or credit card to the Google Pay account to transfer money into it.

There are no bells and whistles. It’s probably the simplest, inexpensive way to give your kids a place to save and spend their money.

The great news is there are a lot of retailers who accept Google Pay directly, without the need for a credit card. These are popular retailers like Dunkin Donuts, Whole Foods, Walgreens, and many more.

Teaching Children Financial Responsibility

It isn’t easy to learn financial responsibility. Unfortunately, schools don’t teach it. So, it’s up to parents and family to give kids a solid financial education. There are plenty of websites that teach kids money management skills.

And if they want to earn more, there are even ways kids can earn money on the internet. Earning money is a great first step toward building good financial health.

Image Credit: yacobchuk1/Depositphotos