You can earn boatloads of money, but it’s useless if you don’t know what to do with it. These financial literacy games teach students and adults the basics of finance and managing one’s money.

Money makes the world go round, but personal finance is still not one of the basic subjects taught in most schools. People worldwide struggle to understand budgeting, investments, debt, banking, insurance, and other financial instruments. If you’re out of your depth, these games simplify the basics of finance so you can finally get a grip on your cash.

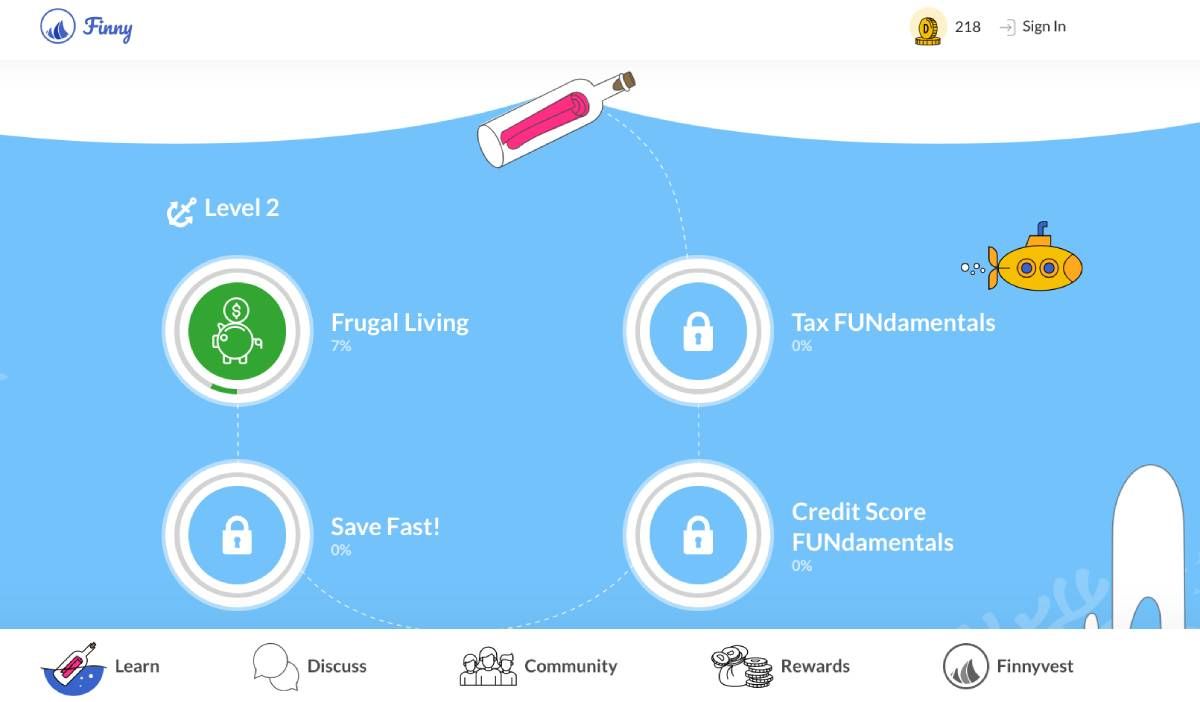

1. Finny (Web): Financial Literacy Quiz for Daily Learning

Finny is a quiz-based game to learn about financial planning through short daily Q&A sessions. When you sign up for Finny, you have to choose what you want to learn more about, such as budgeting, taxes, credit scores, debt, insurance, investments, and other financial topics. There are three levels you can pick from: casual (5 mins/day), regular (10 mins/day), and serious (20 mins/day).

Finny will send you an alert with a custom quiz, which takes you through different basics of money planning. It’s a 10-part, multiple-choice quiz. After every answer, there’s a short explanation about which is the right choice, giving you a quick but valuable education to learn personal finance basics and manage your money.

Correct answers earn you a virtual currency called Dibs. Dibs can be used in giveaways or exchanged to other users for helping out with financial questions. Finny has a community of active users discussing their money issues on a forum, where you can participate to give or receive advice.

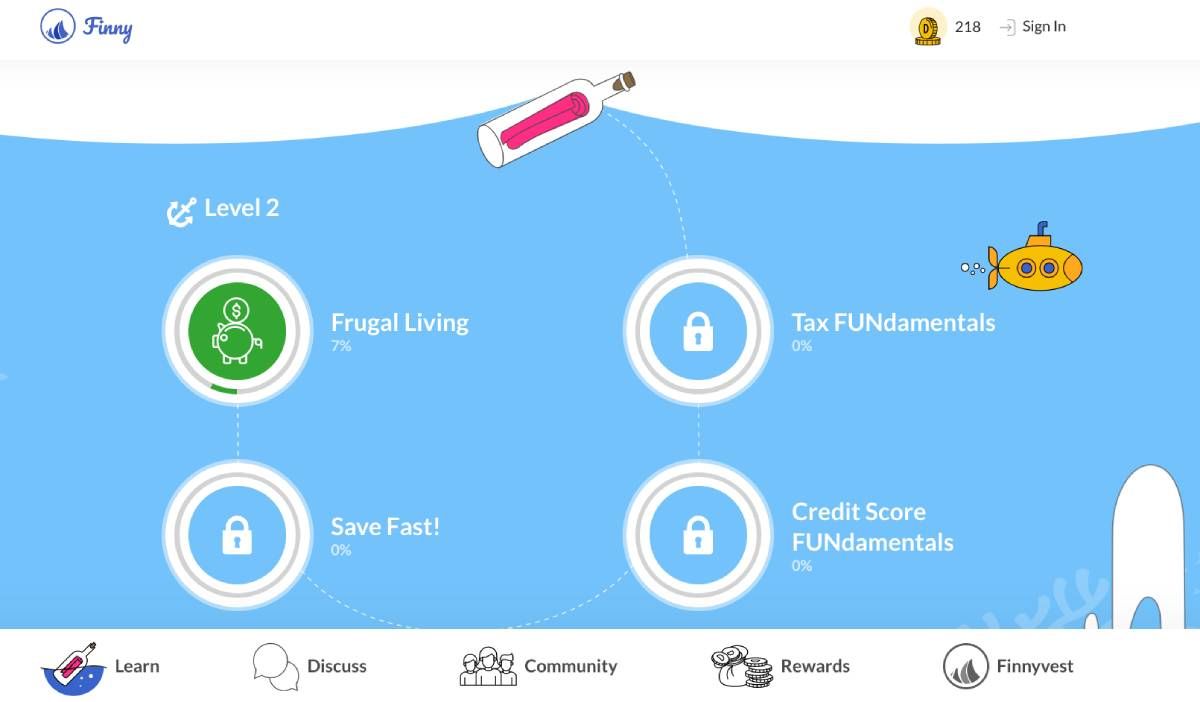

2. The Uber Game (Web): Can You Plan to Survive as an Uber Driver?

How do you manage money in the gig economy? The Financial Times created a short online game where you take on the role of an Uber driver. The idea is to make your $ 1000 mortgage within one week. Can you do it?

The animated game poses different situations through a series of multiple-choice questions. You’ll need to decide what to buy for your car, how you handle things like unruly customers, and take calls about chasing surge prices or other quick-money opportunities. It’s meant to simulate what an average Uber driver in California goes through.

There’s an easy mode and a difficult mode, and it’s better to start with the easy one. For each decision, The Uber Game will tell you why it was the right or wrong choice. Sometimes, a choice you make now will affect you later in the week, so think about the long term. Getting to that $ 1000 mark will not be easy, and you’ll learn some important money lessons along the way.

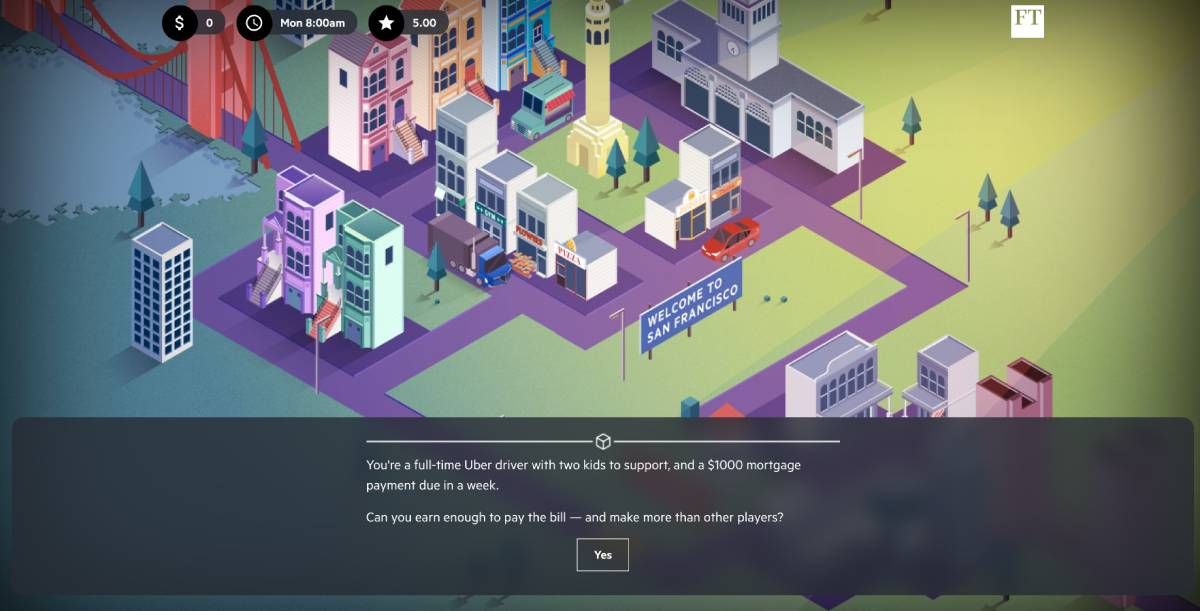

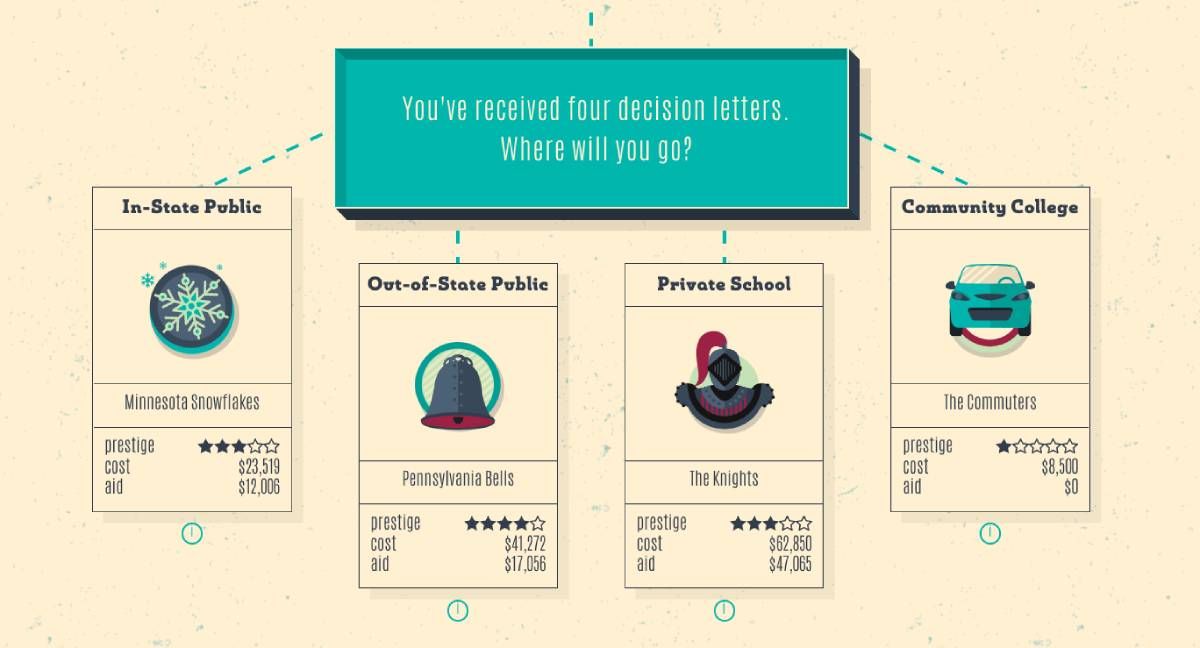

3. Payback (Web): Financial Simulator to Learn How to Reduce College Debts

Good personal finance management is about reducing debt and increasing wealth. For many Americans, college debts are the most significant arrears. Payback is an online game cum simulator to help students realize the various choices by which their college debt can increase or decrease.

The game takes you through the four years of life in college as a freshman, sophomore, junior, and senior. In each year, you will have to make multiple decisions like where you choose to stay, what you eat, how you pick your specializations, your daily routines, and friendly outings, and so on.

Payback will tell you the effect of each choice on your debt, as well as on your happiness, focus on studies, and social circle. The goal is to exit college with a debt that is less than the average annual salary at your first job while still being a well-rounded individual.

Answer the questions as honestly as you can, not based on trying to “win” the game, and you’ll have a realistic picture of your eventual college debt. Feel free to play the game multiple times with different choices to learn how you can best reduce debt.

4. EuroInvestment (Web): 15 Mini-Games to Learn Personal Finance

EuroInvestment is a project to promote financial literacy among adults in the European Union. While the focus is on Europeans, it’s actually pretty basic and universal personal finance advice and principles that anyone would benefit from.

The project is a set of 15 mini-games across three major categories: risk and credit, money and transactions, and planning and managing. The games are a series of interactive videos with quizzes. Each one has a short tutorial before you start and is generally intuitive to play.

The focus of EuroInvestment is on adults, not students or children. So the questions and concepts are also more suited to someone who is earning their own money and living an independent life. It’s ideal if you struggle with themes like exchange rates, interest rates, credit scores, budgeting, and other responsible activities.

5. ProjectiFi (Web): Privacy-Friendly Financial Simulator to Create a Money Plan

Many financial simulators ask to connect to your bank account or seek similar information from you. If you’d prefer not to divulge that data, ProjectiFi is a privacy-friendly financial simulator to understand how to plan your money.

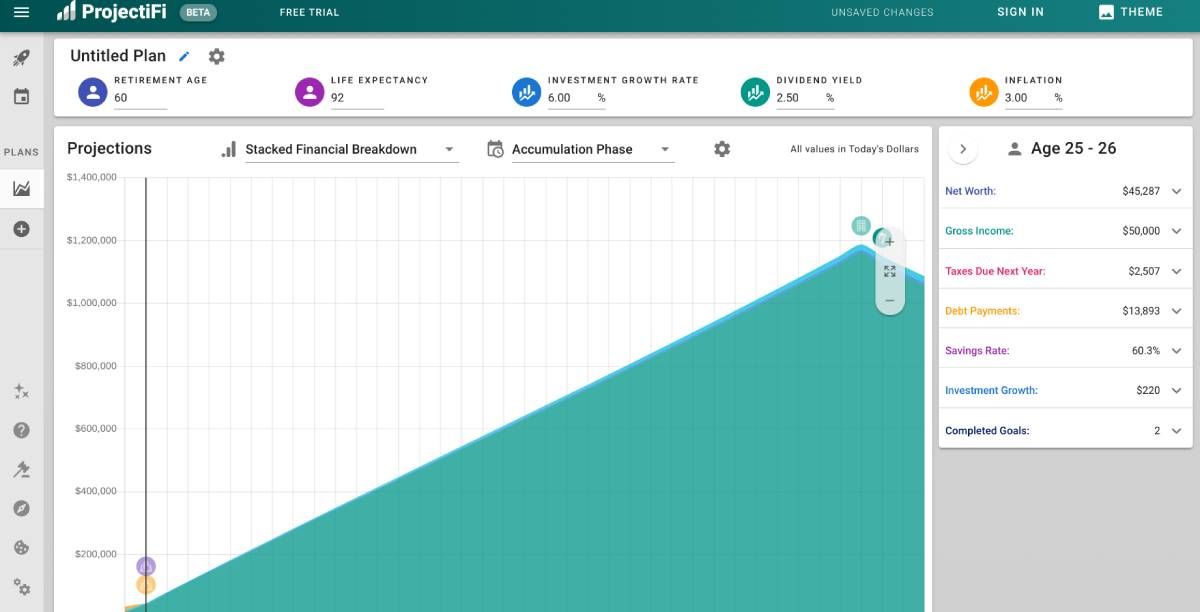

ProjectiFi starts by asking you what age to begin simulations from and an idea of your current financial situation in terms of savings, investments, debts, and other assets. Set up all of those, and then create a plan.

The plan considers factors like your expected retirement age, life expectancy, investment growth rate, dividend, and inflation. You’ll also need to add all current and future income projections. If you’re unsure what any of these terms mean, there’s a handy explanation in each ProjectiFi element. It’ll guide you through each step of adding debts, financial goals, and other money matters.

In the end, ProjectiFi presents you with a clear projection of your financial future, with everything like income, taxes, debt payments, and other info for every year of your life. You can see where your wealth and expenses will be if you continue with this plan in a neat chart. You can edit and adjust the plan to include new goals or expenses too.

The free version of ProjectiFi is good enough for most people to run a financial simulation of their future and get a decent financial plan going.

Personal Finance Management Requires Practice

The different games in this article teach you the basics of personal finance and how to handle money. Use these as the training ground to understand your money. Don’t rush into changing how you manage money without laying a solid foundation of principles.

That said, don’t just sit back. Whether it’s personal finance YouTube gurus or renowned consultants and columnists, all money experts advise one basic principle: you need to practice. You can’t look at your money just once a year and expect things to fall into place. The more regularly you practice the tenets of money management, the better your financial situation will look.